How do AI agents help real estate attract customers

The real estate industry is currently navigating its most significant technological transformation since the advent of the internet.

For decades, the standard for customer attraction relied on passive digital tools: static websites, simple contact forms, and basic email autoresponders.

Today, we are witnessing the “Agentic Shift.”

This is the transition from passive digital tools to active “Agentic AI”—autonomous systems capable of reasoning, planning, and executing complex workflows without human intervention.

In 2025, customer attraction is no longer a linear funnel but a dynamic ecosystem where AI agents act as the primary interface between inventory and demand.

This guide explores how forward-thinking brokerages are utilizing these technologies to reduce costs, increase speed-to-lead, and secure inventory in a competitive market.

From Static Forms to Conversational Autonomy

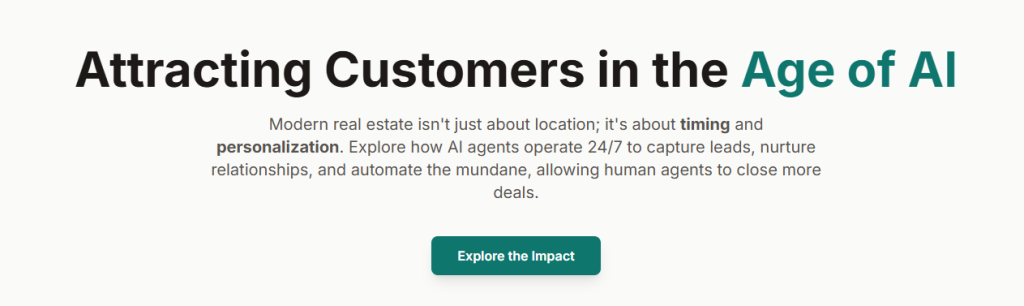

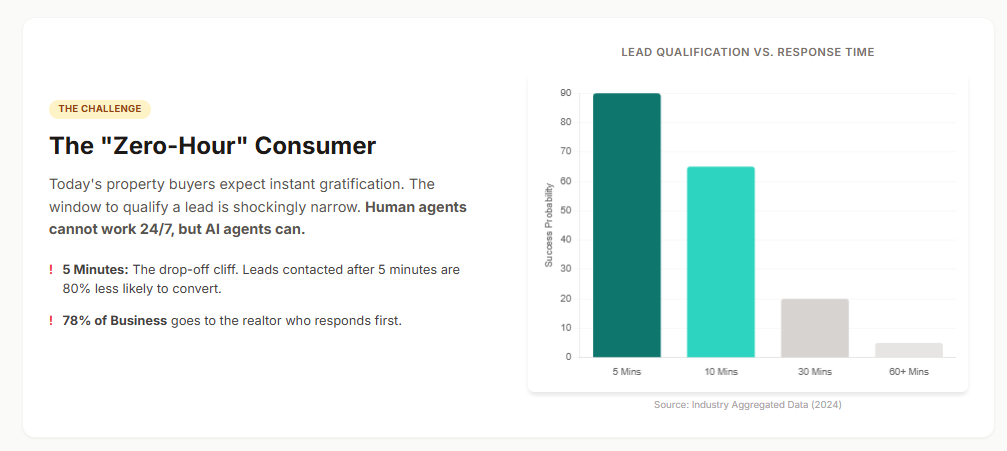

The traditional “capture and hold” strategy of lead generation is obsolete.

Historically, prospective buyers filled out web forms, and these leads sat in a CRM queue until a human agent was available.

This latency created a “speed-to-lead” gap that killed conversion rates.

Modern Agentic AI has fundamentally altered this dynamic by introducing instantaneous, 24/7 engagement.

The Mechanics of “Always-On” Engagement

Unlike the rule-based chatbots of the past, modern AI agents utilize Large Language Models (LLMs) to understand context and intent.

These systems can manage complex, multi-turn conversations that mimic human interaction with startling accuracy.

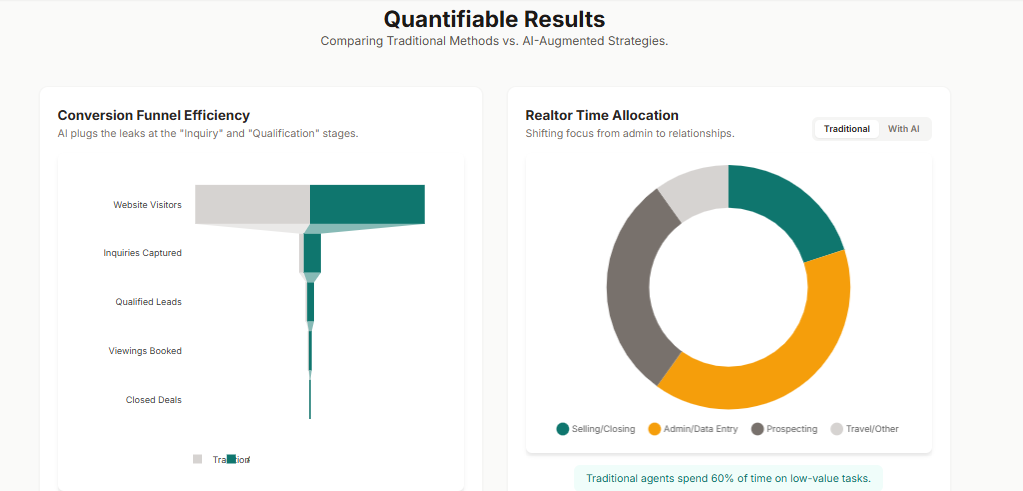

Data indicates that AI agents can reduce lead screening time by approximately 75%.

This efficiency is achieved by automating the “top-of-funnel” qualification process.

If a prospect submits an inquiry at 11 PM, an AI agent immediately initiates a conversation.

It confirms mortgage pre-approval, determines budget parameters, and even schedules showings without human intervention.

Research suggests that leads receiving a response within five minutes are significantly more likely to convert than those contacted after 30 minutes.

Case Study: Operational Impact in Multifamily Real Estate

The efficacy of this technology is best illustrated by its application in the multifamily sector.

An analysis of 3,763 properties leveraging AI agents between 2022 and 2024 revealed a stark contrast in performance.

While the national average occupancy rate decreased by 0.5%, communities utilizing AI agents increased occupancy by 2%.

This represents a 2.5% performance delta, a massive revenue impact for asset owners.

These agents handle leasing inquiries, maintenance requests, and renewals simultaneously, ensuring no opportunity is missed.

Checklist: Is Your Brokerage Ready for Agentic AI?

- [ ] CRM Integration: Can the AI write directly to your database?

- [ ] Sentiment Analysis: Does the bot detect urgency or frustration?

- [ ] Handoff Protocols: Is there a clear trigger for when a human takes over?

- [ ] 24/7 Availability: Does the system operate outside of business hours?

The Visual Revolution: Computer Vision and Digital Twins

In real estate, the visual experience is the primary driver of emotional connection.

A listing’s visual presentation dictates whether a buyer stops scrolling or clicks through.

Artificial Intelligence is transforming this vertical through Computer Vision (CV) and Generative AI.

Structuring the Unstructured with Computer Vision

Real estate data has historically been messy—photos without tags and inconsistent descriptions.

Computer Vision algorithms now ingest millions of property photos to identify and classify specific features.

Systems can distinguish between a “chef’s kitchen” and a “galley kitchen” or identify flooring types automatically.

This allows for the creation of rich metadata layers that improve SEO and on-site search functionality.

For example, a buyer can search for “homes with exposed brick,” and the AI will find them even if the agent didn’t mention it in the description.

The Power of Generative Staging

Empty properties often struggle to attract buyers due to a lack of emotional resonance.

Physical staging is effective but prohibitively expensive and logistically complex.

Generative AI has democratized high-quality staging, making it accessible for every listing.

Virtually staged listings receive 40% more online views and attract 74% more interest from serious buyers compared to empty listings.

Furthermore, staged homes spend 73% less time on the market.

Generative AI enables “dynamic staging,” where interior design styles can be toggled to match the viewer’s preferences.

A listing might appear with “Mid-Century Modern” furniture for one buyer and “Traditional Farmhouse” for another.

Next-Gen Tours: Gaussian Splatting

While 360-degree tours have been the standard, new technologies based on Gaussian Splatting are emerging.

This technology represents 3D scenes as millions of points rather than traditional polygons.

This allows for the rendering of complex lighting effects, reflections, and transparencies that traditional scanners miss.

The result is a “fly-through” experience that feels more like a video drone shot than a click-and-drag tour.

Platforms like Luma AI allow agents to capture these tours using just a smartphone, democratizing high-fidelity 3D experiences.

Predictive Analytics: The Science of Seller Intent

Attracting customers is often a game of timing.

Finding a seller after they have listed their home is too late; the goal is to identify them before they contact an agent.

Predictive analytics shifts the strategy from “farming” a geographic area to “hunting” specific homeowners with high selling probability.

Identifying Life Events and Financial Signals

AI algorithms analyze thousands of data points to identify “life events” that statistically precipitate a transaction.

Platforms assign a predictive score to individual properties based on a convergence of factors.

These models can often predict over 60% of off-market transactions before they occur.

Key data points include:

- Financial Distress: Pre-foreclosure notices, tax delinquency, or HOA liens.

- Demographic Triggers: Divorce filings, probate situations, or bankruptcy.

- Behavioral Indicators: Online searches for home valuation tools or moving companies.

By utilizing these scores, agents can drastically reduce their Marketing Customer Acquisition Cost (CAC).

Instead of mailing 5,000 postcards to a generic zip code, an agent might mail 500 high-quality packages to households with top turnover probability.

This targeted approach can lead to a 37% reduction in CAC.

Table: Traditional vs. AI-Driven Lead Generation

| Feature | Traditional Farming | AI-Driven Predictive Analytics |

| Targeting | Geographic (Zip Code) | Behavioral & Demographic Signals |

| Timing | Reactive (Waiting for listing) | Proactive (Before listing) |

| Cost | High (Mass mailing) | Low (Targeted spend) |

| Conversion | Low (< 1%) | High (High intent) |

| Data Source | Public Records Only | Online Behavior + Public Records |

Recommendation Engines and Hyper-Personalization

The “Netflix-ification” of real estate search is reshaping how buyers discover properties.

Traditional search filters are rigid and often exclude relevant properties that miss a single criterion.

AI recommendation engines utilize collaborative filtering to provide a more fluid discovery process.

Beyond Keywords: Semantic Search

Traditional keyword search is brittle; it looks for exact matches.

Semantic search uses vector embeddings to understand the meaning behind a query.

Realtor.com implemented an AI-powered search allowing users to query in natural language.

For example, a user can type “Victorian home with a big backyard near a park.”

Users engaging with this AI-powered search converted at a rate 4.6 times higher than those using legacy search tools.

Visual Similarity Search

Buyers often struggle to articulate their aesthetic preferences in words.

Visual search engines allow users to upload a photo of a kitchen they like to find similar listings.

This technology relies on deep learning to extract visual vectors from images—analyzing cabinet style, countertop material, and layout.

It matches these vectors against the listing database to find “hidden gems.”

Governance, Ethics, and Fair Housing Compliance

The deployment of autonomous agents in real estate introduces significant legal and ethical risks.

Adhering to the Fair Housing Act (FHA) is paramount when using algorithmic tools.

The Risk of Algorithmic Bias

AI models trained on historical data risk perpetuating historical biases.

If an algorithm learns that certain demographics have historically purchased in specific neighborhoods, it might “steer” new buyers.

This effectively automates segregation and violates the FHA’s anti-steering provisions.

The US Department of Housing and Urban Development (HUD) has issued specific guidance on this matter.

Ad platforms using algorithmic delivery must not target or exclude consumers based on protected characteristics.

These characteristics include race, color, religion, sex, handicap, familial status, or national origin.

Mitigation Strategies for Brokerages

Brokerages must conduct regular “end-to-end testing” of their advertising systems.

This involves running pairs of ads for equivalent housing opportunities and comparing the delivery audience.

This ensures no disparate impact occurs against protected groups.

Furthermore, there is a legal imperative to identify and adopt “less discriminatory alternatives” for AI models.

Key Compliance Checklist:

- Vendor Vetting: Do your AI vendors test for bias?

- Audit Trails: Can you explain why the AI rejected a tenant application?

- Human Oversight: Does a licensed agent review AI-generated listing copy?

- Data Privacy: Are you protecting client financial data from public AI models?

Conclusion: Embracing the Agentic Future

The integration of AI agents into the real estate sector represents a fundamental shift in business mechanics.

We are moving from a model of reactive service to one of predictive engagement and strategic foresight.

By leveraging predictive analytics, agents can identify seller intent before it becomes public knowledge.

Computer vision and generative staging are revolutionizing the visual merchandising of homes.

Conversational AI has solved the speed-to-lead crisis, ensuring instantaneous qualification.

However, this technological prowess must be balanced with rigorous governance.

The winners in this new era will be those who integrate these tools into a compliant, human-centric workflow.

The future of real estate is agentic, data-driven, and hyper-personalized.